QCO Credit Amounts

2025 Maximums:

• $495 – Single, Married Filing Separate, or Head of Household

• $987 – Married Filing Joint

2026 Maximums:

• $506 – Single, Married Filing Separate, or Head of Household

• $1,009 – Married Filing Joint

Direct Your Impact

Donors may designate a specific program or area they want their contribution to support.

Filing Reminder

Donations made in 2025, or from Jan 1–Apr 15, 2026, may be claimed on your 2025 return (up to 2025 limits). To use the higher 2026 limits, claim your early-2026 gift on your 2026 return instead.

Please consult your personal tax professional to understand how the credit applies to your individual situation.

Your generosity directly strengthens UCPSA’s mission to help people live independently, safely, and with dignity. Thank you for keeping your charitable dollars local and making a meaningful impact in Southern Arizona!

DONATE NOW

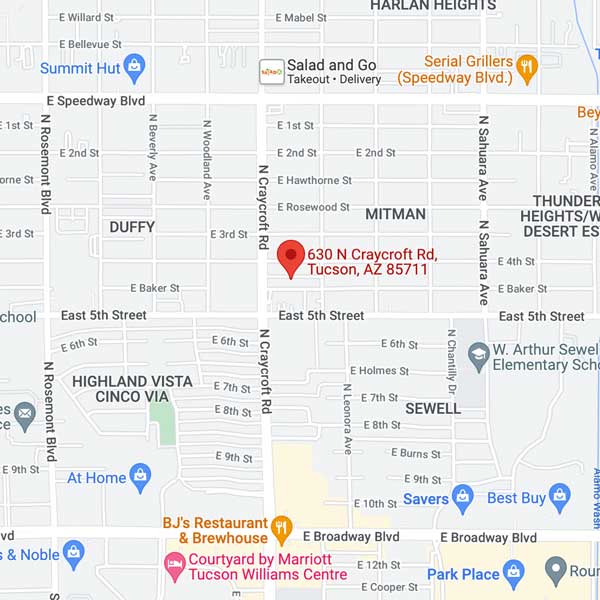

DONATE NOWLocated just north of the Craycroft and 5th Street intersection, on the northeast corner.

UCP of Southern Arizona

630 N. Craycroft Road

Tucson, AZ 85711-1450

English / Español: 520.795.3108

On Call: 520.548.4969

WorkAbility: 520.795.3108

FAX: 520.795.3196

E-mail: staff@ucpsa.org

WorkAbility E-mail: workability@ucpsa.org

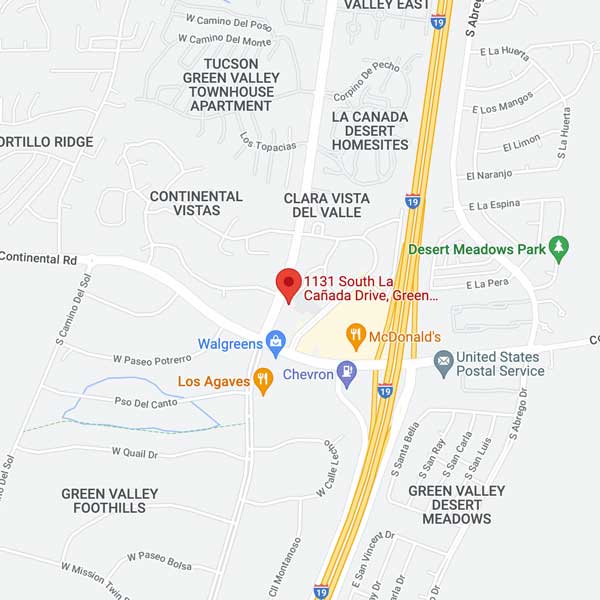

We have a regional office serving the cities south of Tucson (Sahuarita to Nogales).

UCP of Southern Arizona

1131 S. La Cañada Drive, Suite 105

Green Valley, AZ 85614

English / Español: 520.347.6950

On Call: 520.955.1706

FAX: 520.347.6917

E-mail: staff@ucpsa.org

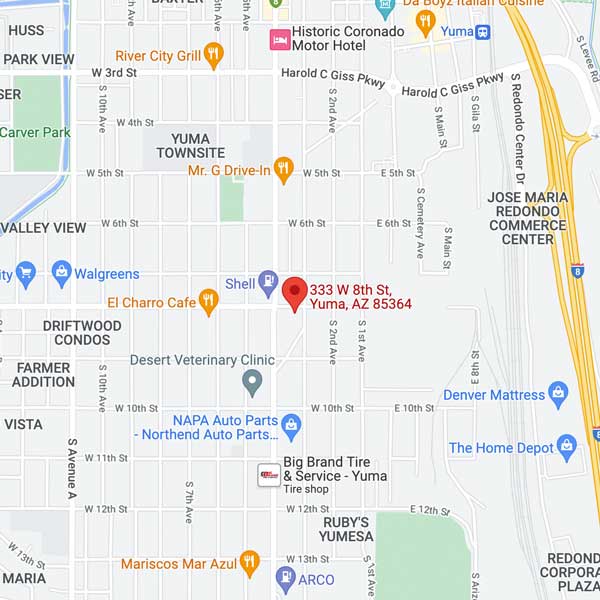

We also provide services in Yuma!

UCP of Southern Arizona

333 W. 8th Street

Yuma, AZ 85364

WorkAbility Office

281 W. 24th Street, Suite 147

Yuma, AZ 85364

English / Español: 928.259.7700

On Call: 928.509.3338

FAX: 928.259.7697

E-mail: staff@ucpsa.org